This event has now taken place but you can watch the video recording of it through our Youtube Channel, get to it by clicking the button below

When

Tuesday, June 15th from 6pm to 8pm UK timeWhere

Online symposium via Zoom.Format

There'll be a great line-up of speakers plus ample scope for discussion and debate.Why you should attend

This Transparency Task Force symposium is timed to coincide with the World Elder Abuse Awareness Day. However, in the interests of transparency we wish to make it clear that the timing is coincidental i.e. a complete fluke.

However, we can’t escape the reality that the issues that motivated us to run this event in the first place do align very strongly with what the World Elder Abuse Awareness Day is all about – that is a grave concern about the harsh reality that the elderly are vulnerable in many ways including in the risk of having their wealth removed from them.

And let’s be clear on one thing straight off: we are not talking about just the wealthy elderly; no, we are going to be focusing on the wealth of the elderly, however wealthy they may be.

This is a big and complex topic with a multiplicity of interconnected issues. Our overall aim is not to solve the problems for that would be unrealistic. Rather, our aim is to initiate meaningful, ongoing dialogue about the problems the vulnerable elderly face when it comes to holding on to their wealth, with a view to working towards developing TTF’s policy position on these matters and to then go into campaign mode to turn policy initiatives into protective and prudent proposals that can lead to meaningful change, through the Parliamentarians, policy makers and regulators that we can and will engage with.

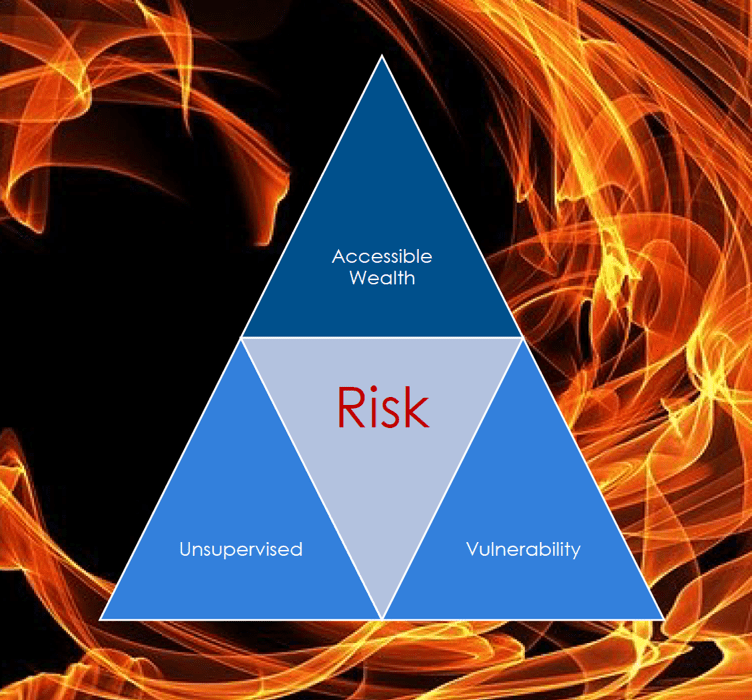

The “Fire Triangle” describes the idea that if you have oxygen, fuel and sufficient heat there will be fire. The diagram below works on the same principle, in that if you have vulnerable people that have accessible wealth that is unsupervised you will have risk. The risk is that the vulnerable elderly are at risk of losing their wealth in a multiplicity of ways.

Our symposium will be exploring the ways that the wealth of the vulnerable elderly is in jeopardy.

We’ll be considering issues such as:

- The protective role that Security Bonds can play

- The protective role that true professionals can play from a legal, wealth management and estate planning perspective

- What scope is there for innovation with regard to inheritance tax; for example perhaps a new Government Bond could be introduced with tax on encashment starting at 40% and tapering off to 0% at the tenth year – all credit to Harold Tillman for the idea

- How property wealth can be better utilised to maintain the quality of life for the elderly in care; with access to good ideas openly available to all, not just those with expensive advisers, whilst recognising the risk of misuse of equity release, particularly when advice about it is siloed

- Whether there is scope to simplify the bewilderingly complex rules and regulations that surround wealth, many of which are unfathomable to the aged

- The desperate need for the Financial Financial Ombudsman Service, recently deemed to be “not fit for purpose” by the Institute of Economic Affairs, to award fair compensation to victims of malpractice, malfeasance, misconduct and mis-selling

- Predation from unscrupulous relatives with or without the added complication of family feuds, for example feuds brought on by objections to the remarriage of a parent following widowhood

- The mis-use or poor use of the Power of Attorney

- Whether the elderly should be restricted from investing in unregulated products

- Improving the way that banks and other financial institutions care for the wealth and interests of their elderly clients

- The whole topic of criminal intent, rip-offs and scams by all kinds of “bad actors” including unethical investment, legal and insolvency “professionals”

- The elderly often being on uncompetitive tariffs for all kinds of things, sometimes lured into them by cunning ‘opt-out’ arrangements where the elderly person buys features he/she doesn’t need or want

- How can the UK’s crime prevention, detection and enforcement agencies raise their game; and should the police be spending more than 1% of their budget on fraud when it accounts for approximately a third of all crime?

- How can the regulators raise their game as well, by properly enforcing their various codes designed to provide additional protection to the vulnerable including the vulnerable elderly – FSMA and COBS being two that apply to financial services

- What scope is there to protect or even increase the true value of the basic old age pension in real terms

- How should later life care be properly funded?

- What should the banks be doing about Authorised Push Payment Fraud; and why aren’t they doing it?

- What are the relative merits of Lasting Powers of Attorney v Deputyships?

- What are the special risk factors associated with unregistered Enduring Powers of Attorney?

- How can proper safeguards be used to add an additional protective layer within legal constructs?

- What changes should be made to the way the Office of the Public Guardian operates?

- What can be done to get more/better data about the amount of abuse of LPAs that have taken place?

- What can be done to address the 4 common assertions that arise in Court of Protection cases which involve the removal of an attorney because they have unlawfully used the donor’s money, namely:

- ‘Mum had capacity and said I could have the money’

- ‘Mum would have wanted me to have this money, if she had mental capacity’

- ‘It will all be mine eventually’

- ‘I deserve this for the sacrifice I am making’.

That’s a long list of issues for us to consider. We won’t be able to cover them all but it just goes to show how deep, complex and interconnected the problems are. Ultimately, we are working towards co-creating a policy paper that will comprehensively set out the problems and what can be done about them.

Here's the programme and timings so far...

—————————————-6:00pm BST—————————————-

Welcome to the symposium, introductions and initial exploration of the main issues; by

Andy Agathangelou

Founder, Transparency Task Force; Governor, Pensions Policy Institute; Chair, Secretariat Committee, APPG on Pension Scams; Chair, Secretariat Committee, APPG on Personal Banking and Fairer Financial Services; Chair of the Violation Tracker UK Advisory Board

—————————————-6:20pm BST—————————————-

Presentation #1, for 15 minutes + 5 minutes Q&A/Discussion by

Paul Greenwood

Elder Abuse Expert Witness & Teacher/Consultant

—————————————-6:40pm BST—————————————-

Presentation #2, for 10 minutes + 5 minutes Q&A/Discussion by

Ken Kivenko

President, Kenmar

—————————————-6:55pm BST—————————————-

Presentation #3, for 10 minutes + 5 minutes Q&A/Discussion by

Richard Emery

Fraud Investigator, 4Keys International

—————————————-7:10pm BST—————————————-

Sebastian Elwell FPFD TEP

Director, My Switchfoot Team Limited

—————————————-7:25pm BST—————————————-

The “Just a minute”-round

Inspired by the BBC Radio 4 programme, we have asked a selection of our attendees to spend just a minute sharing their thoughts on what has been covered during the symposium. But unlike the Radio 4 programme our speakers won’t be penalised for hesitation, repetition or deviation!

Speakers:

TBC

—————————————-7:30pm BST—————————————-

General discussion and debate, 25 minutes

—————————————-7:55pm BST—————————————-

Final conclusions; and suggested next steps and close to the formal proceedings.

However, for those that want it…

8:00pm BST until 108:30pm BST

….informal, unstructured networking and informal conversation; a “fireside chat”

___________________________________________________________________

*The programme will continuously evolve so is subject to change.

Paul Greenwood

Elder Abuse Expert Witness & Teacher/Consultant

Newly retired Deputy District Attorney Paul Greenwood was a solicitor in England for 13 years. After relocating to San Diego in 1991 he passed the California Bar and joined the DA’s office in 1993. For twenty two years Paul headed up the Elder Abuse Prosecution Unit at the San Diego DA’s Office. In 1999 California Lawyer magazine named Paul as one of their top 20 lawyers of the year in recognition of his pioneering efforts to pursue justice on behalf of senior citizens.

He has prosecuted over 750 felony cases of both physical, sexual, emotional and financial elder abuse. He has also prosecuted ten murder cases, including one death penalty case.

In March 2018 Paul retired from the San Diego DA’s office to concentrate on sharing lessons learned from his elder abuse prosecutions with a wider audience. In October 2018 he was given a lifetime achievement award by his former office.

Paul now spends much of his post retirement time consulting on elder abuse cases and providing trainings to law enforcement and Adult Protective Services agencies across the country and internationally. He is also involved as the criminal justice board member of National Adult Protective Services Association.

![]()

_________________________________________________________________________________________________________________________________________

Ken Kivenko

President, Kenmar Associates

Since 2001 Ken Kivenko has been president and CEO of Kenmar, a company providing consulting services to small and medium-sized enterprises regarding strategic planning and financing. The company also acts as an investor advocate assisting investors who have been wronged. Some of Ken’s acheivements at Kenmar include:

– Assisting companies in developing corporate governance procedures,

– Writing research papers on investing including investor psychology and portfolio risk management, and

– Assisting wronged investors successfully file complaints and damage claims.

Ken has been successfully investing for over 30 years in stocks , bonds, convertibles, and mutual funds. He has given papers at various conferences; subjects include corporate/fund governance, investing principles, inventory management, customer satisfaction, investment metrics and risk mitigation. As an investor advocate, he has written and widely distributed papers on investment issues and corporate governance. He is chairman of the Advisory Committee for the Small Investor Protection Association. He has made presentations and provided submissions to the OSC ,CSA, Joint Forum, IOSCO, IDA and The Wise Persons Committee.

Ken has a bachelor of science in engineering electronics and a diploma in management from McGill University. He also has a Canadian Securities Course Certificate from the Canadian Securities Institute.

He has previously held positions as president and CEO of NBS Technologies (1995 to 2000), Canadian Marconi Company (1994-1995), AlliedSignal Canada Inc. (1989-1994), and Bendix Avelex Inc. (1984-1989). Prior to this, he worked for Canadian Marconi Company (1966-1984), first as a senior quality engineer and later as vice-president.

_________________________________________________________________________________________________________________________________________

Richard Emery

Bank Fraud Consultant, 4Keys International

Richard started his career training as an accountant but soon discovered the then new world of computing. After working for a couple of technology companies, he joined John Lewis Partnership where he became the Project Manager for the design, development and implementation of the Electronic Point of Sale (EPoS) systems in their department stores.

After brief spells in two small technology companies Richard joined ICL Retail Systems as a Retail Business Consultant. This allowed him to play a significant role in the design and development of systems that covered the entire retail process from initial product purchase, through warehousing and distribution, to retail sales and payments.

He set up an independent Retail Business Consultancy in 1990, working with both retailers and technology suppliers in UK, Europe and USA. His investigative and analytical approach soon resulted in him being asked to serve as an Expert Witness in civil disputes regarding retail computer systems.

In 2004 Richard accepted his first Instruction on behalf of a Defendant in a Criminal case. A young retail sales assistant was accused of. She was found not-guilty at the end of a 4-day trial during which Richard gave vital oral evidence. He continues to serve as an Expert Witness in cases of Retail Theft and Fraud.

Since 2013 Richard’s investigative and forensic analytical skills have focussed on credit/debit card fraud and bank fraud. He has assisted individuals, small businesses and charities to challenge the banks and FOS, resulting in refunds ranging from £100s to over £250,000. In 2017/8 he successfully challenged the way that the banks were interpreting the term “gross negligence”. In August 2018 he was asked to write an article on APPF for FOS Ombudsman’s News, resulting in a live appearance on the Victoria Derbyshire show. He is regularly quoted in the media or interviewed on radio and TV. Then in November 2018 he was invited to give oral evidence to the Treasury Committee investigation into Economic Crime. The resulting report was published on 1st November 2019, endorsing much of what Richard had said, and quoting him in several sections.

He is currently challenging the banks to establish an Historic Reimbursement Scheme for victims of APPF since 2014, primarily on the basis that they have been ‘grossly negligent’ by failing to deliver Confirmation of Payee even when the risks of not providing CoP became clearly obvious.

_________________________________________________________________________________________________________________________________________

Sebastian Elwell

Director, SwitchFoot Wealth Limited

Seb has been working in financial services since 2004 and a regulated financial planner since 2007. He launched Switchfoot Wealth in 2018 and Switchfoot Teams in 2019 with an ambition to improve financial planning for later life clients and support attorneys, court-appointed deputies and trustees in their important role. Seb is working with the Transparency Taskforce to raise awareness of LPA abuse, the particular risks of drawdown pensions in this context, and what can be done to protect vulnerable consumers from harm.

_________________________________________________________________________________________________________________________________________